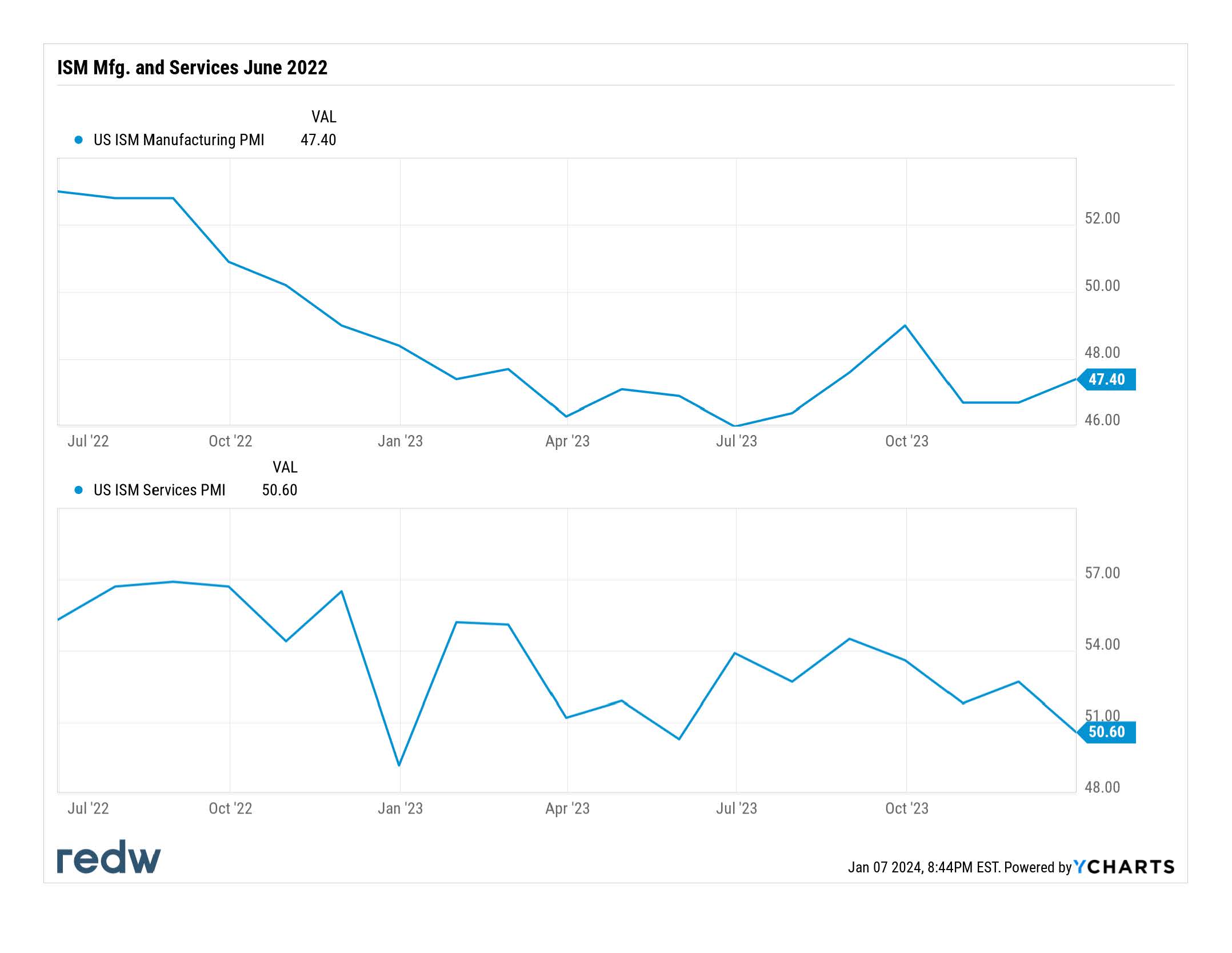

Perhaps the biggest surprise of 2023 was the strength of the U.S. economy. Not only did we avoid a recession, but we had solid headline growth. When we dig into the numbers, however, not everything was so rosy. Inflation outside of food and energy was more persistent, which led the Federal Reserve to indicate they would be holding rates higher for longer. Also, ISM manufacturing contracted throughout 2023 and the first ISM report for 2024 is indicative of ongoing weakness. ISM manufacturing has increased to 47.4, but that is still in contraction territory, and ISM services has flattened to 50.6, which, while technically in expansion, is not far from contraction.

In the chart above we expanded the time frame to show how ISM manufacturing has been in contraction for 14 straight months. ISM services has generally remained above 50, and the decline in the latest reading might also turn around, as we saw happen last year. Should the downward trend persist, however, we could be seeing a slow movement into recession.

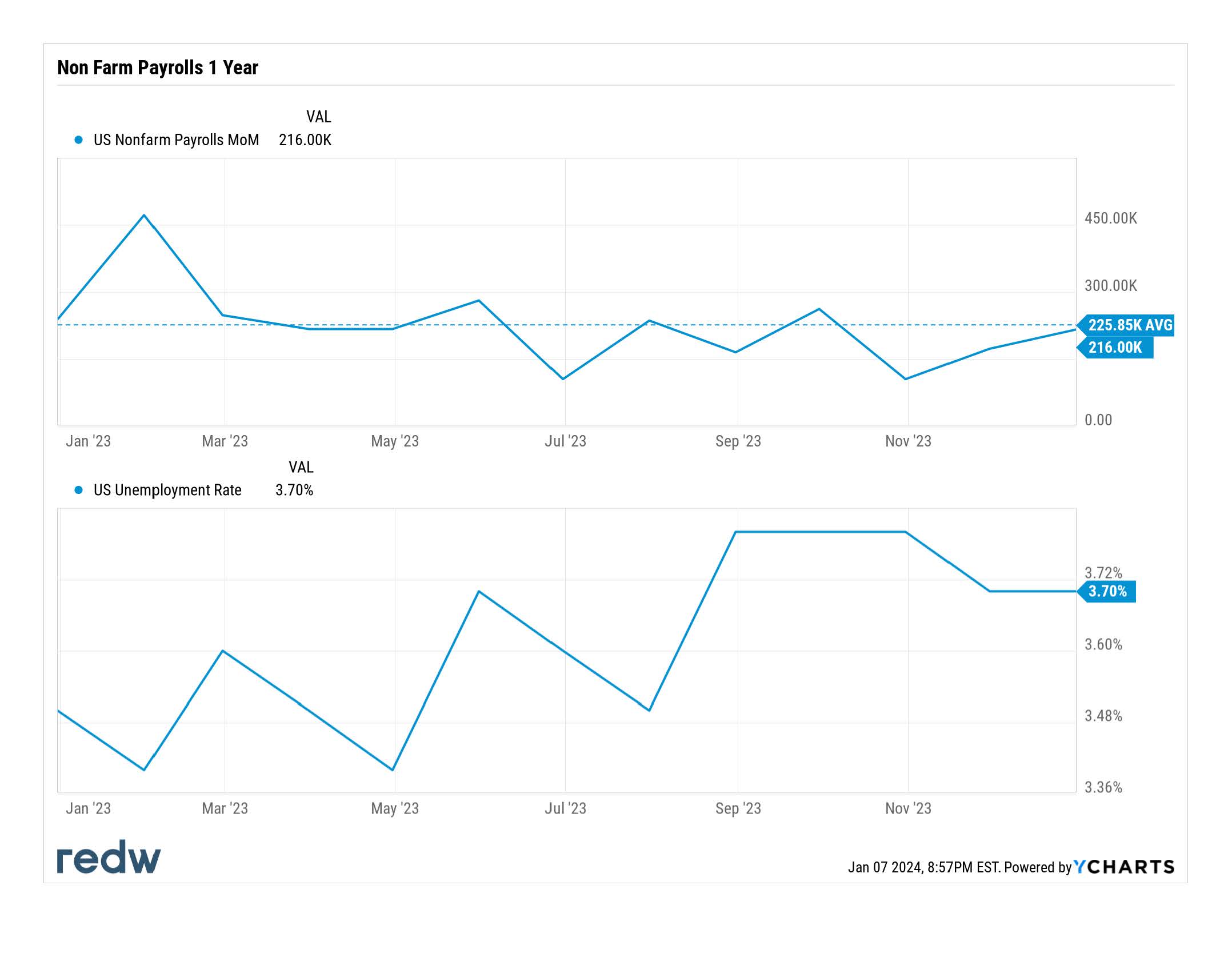

Payroll Numbers

Last week also saw the first payroll number release in 2024, which came in near average at 216,000 with the unemployment rate holding steady at 3.7%.

While the headline number is respectable, we also note that the payroll numbers for prior months were revised down 71,000 bringing the number down to 145,000. Overall, payroll growth has been solid, with the economy adding 2.1 million jobs in 2023.

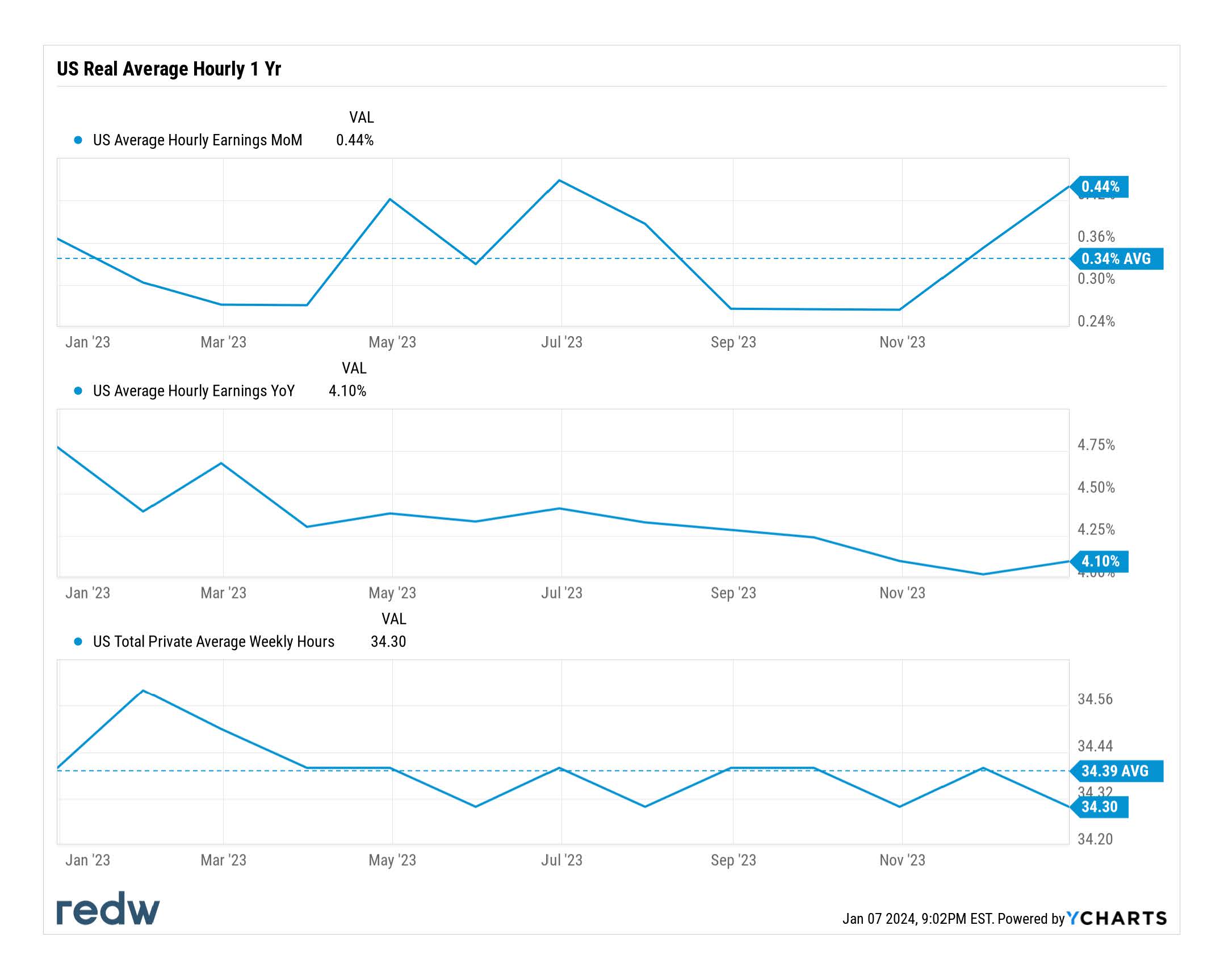

Average hourly earnings, which increased 0.44% for the month, are now up 4.1% over the last 12 months. As a moderating factor, the average weekly hours decreased slightly to 34.3 hours.

Looking Ahead at 2024

Given the Federal Reserve’s elevated rates and the time lag that changes in monetary policy can experience, we believe there is still a very meaningful chance of recession. Potential geopolitical problems, higher rates, and general weakness in housing could all prove to be headwinds to economic growth. However, the odds of a soft landing (no recession and ongoing declines in the rate of inflation) have definitely improved.

Of course, the Federal Reserve has indicated it wants to see sustained declines in inflation before declaring victory over inflation, anticipating three rate cuts in 2024.

2024 is shaping up to have plenty of drama.

Contact our trusted wealth management advisors with any questions at the link below.

[hubspot type=cta portal=20990958 id=2b658eb3-b436-4086-b48e-0007e377cb47]More From REDW Wealth Management

© 2024 REDW Wealth LLC. This publication is intended for general informational purposes only and should not be construed as investment, financial, tax, or legal advice. Information and instruction shared in the article above do not guarantee outcomes, performance, or quality of services provided to REDW Wealth Management clients by REDW Wealth Management or its employees. Adherence to our fiduciary duty is not a guarantee of client satisfaction or any particular outcome. Advisory, Assurance, and Tax is offered through REDW LLC. Wealth Management is offered through REDW Wealth LLC.