Greater Transparency

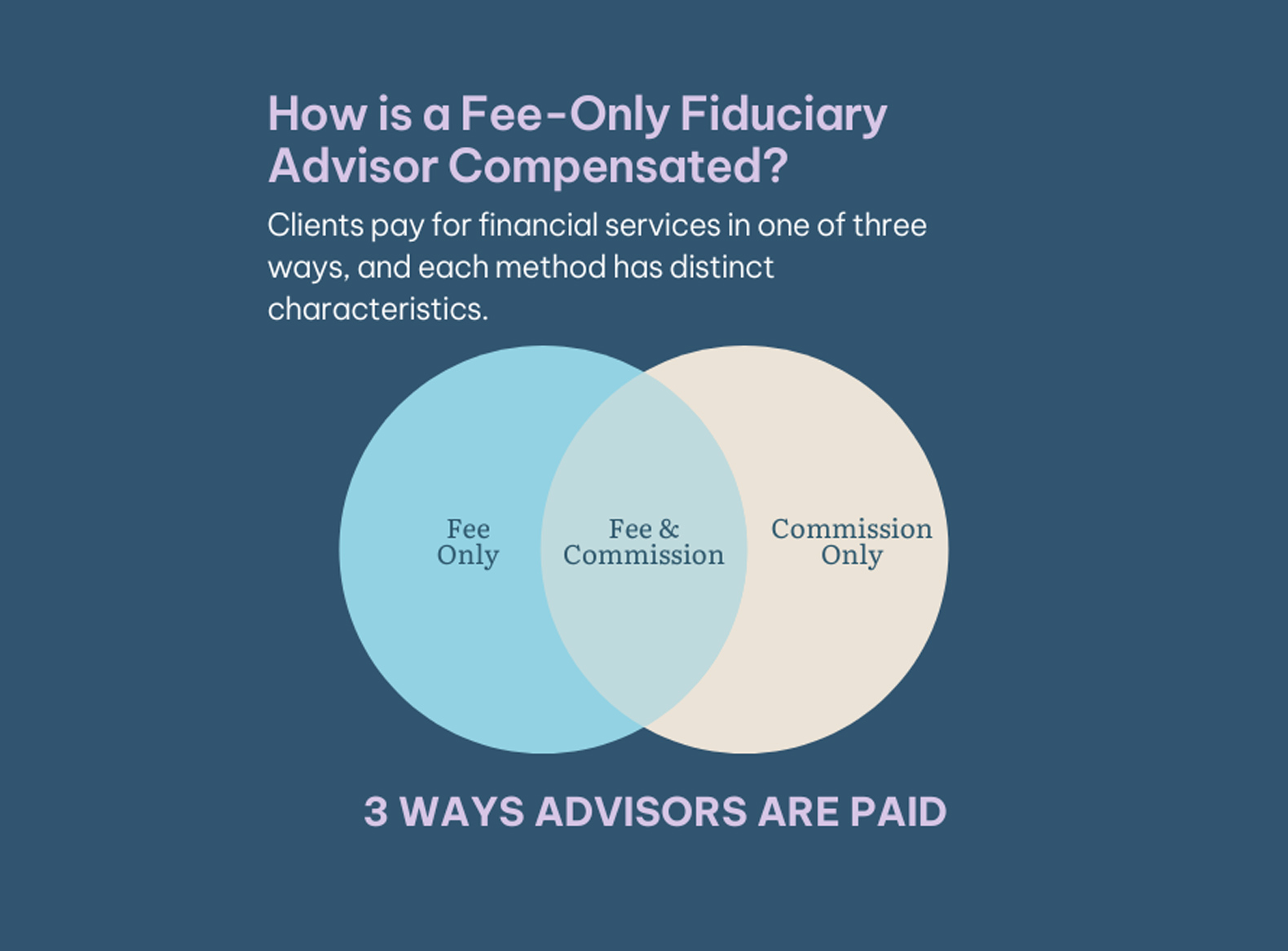

Commission-based advisors purchase stocks, mutual funds, and other investment products on behalf of their clients and use various service providers to execute the exchanges. The advisors will likely disclose that they receive a percentage of the purchase price as their compensation, but other benefits they receive may not be as obvious.

Insurance premiums and other prices charged to clients of commission-based advisors may be inflated to reflect the seller’s commission expense. Rebates and bonuses received after a certain number of purchases may be earned from specific sales to several clients and are unlikely to be prominently defined and disclosed to each client.

Clients entering a business relationship with fee-only advisors are fully aware of the costs they will be charged for services rendered.