by David Cechanowicz, JD, MSFS, AIF®, AEP, AE – Senior Financial Planner

REDW Stanley Financial Advisors, LLC

In the Winter 2018 issue of her Capital Conversations newsletter, Laura Hall introduced a colorful visual aid that outlines the breadth of wealth management services offered by REDW Stanley Financial Advisors. Our “Universe of Financial Advice, Planning and Wealth Management†map shows that we provide planning advice in six broad categories:

- Retirement Planning

- Estate Planning

- Business Planning

- Investment Planning

- Tax Planning

- Risk Management

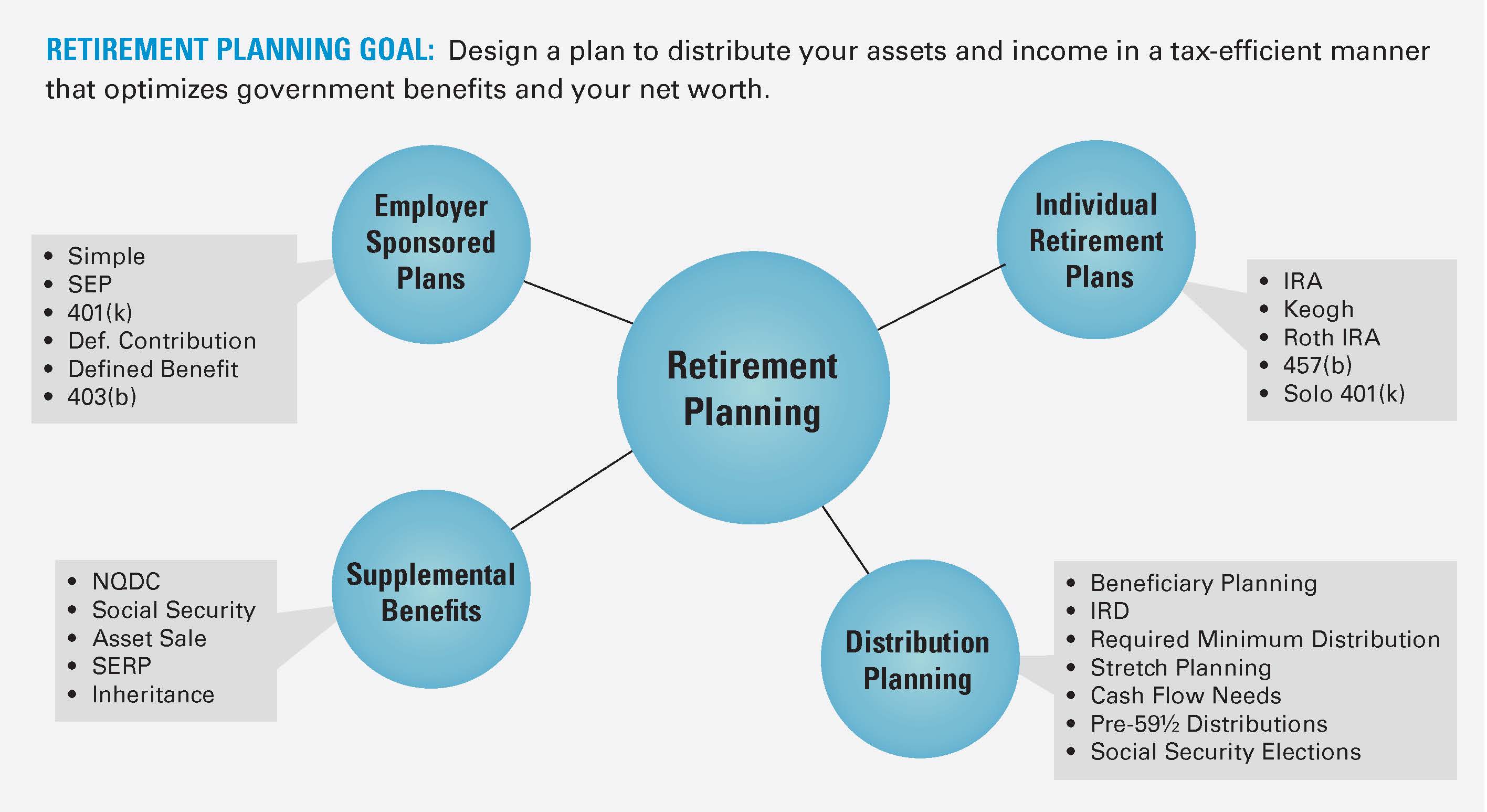

This month, we are focusing our attention on the Retirement Planning section of the map. We’re starting here because most of the planning advice we are asked to provide centers on retirement-related issues. Whether you are near or far from the subject, most people have long range goals that revolve around retirement.

Retirement planning begins with an evaluation of your current financial situation and results in the design of a strategy for accumulating the assets needed to support your desired lifestyle in retirement. Since retirement plans can span decades, retirement planning generally dominates other financial goals. A well thought out plan will address how to maximize growth, optimize Social Security, claim other retirement benefits, and plan for tax-efficient distribution. It will also cover how to leave retirement assets in your legacy bequests.

Ways to Save for Retirement

There are primarily two ways to save for retirement: on a pre-tax basis or an after-tax basis. Pre-tax funds focus on assets accumulated in employer-sponsored retirement plans, called qualified plans.

After-tax savings are primarily funded with the money left over after all of your expenses, including taxes, are paid.

Sources of Retirement Income

While there are two main systems of saving for retirement, REDW Stanley works with three primary sources of retirement income and assets: (1) retirement plans offered by employers; (2) individual retirement plans for self-employed or formerly employed individuals; and (3) supplemental benefits offered by employers. We additionally include inheritances and government-provided benefits, both Social Security and pensions from non-covered employment (such as school teachers and other state or county workers).

Because there are very specific legal and tax issues that surround distributions from retirement plans, distribution planning becomes the fourth major area of importance in the retirement plan space. This area of planning meshes well with REDW Stanley’s unique expertise in combining income tax planning with retirement distribution planning. When we add in claiming strategies for Social Security retirement benefits, our clients frequently benefit from a retirement income plan that optimizes the combination of their assets, government benefits and other retirement income sources.

When it comes time for you to retire, there may be periods during which there is an income gap, and there is insufficient income to meet your retirement needs. The financial planning professionals at REDW Stanley can help to develop strategies for claiming Social Security benefits, and design withdrawals from various accounts to meet your cash flow needs in the most tax-efficient manner.

A Fiduciary Perspective

It’s worth noting that all of the advice REDW Stanley advisors give to clients must pass through a fiduciary lens—meaning that, as fiduciaries, we are required only to give advice that is in the client’s best interest.

Copyright 2018 REDW Stanley Financial Advisors, LLC. All Rights Reserved. This publication is intended for general informational purposes only and should not be construed as investment, financial, tax, or legal advice.