Are you in compliance with the SECURE Act for Inherited IRA Required Distributions?

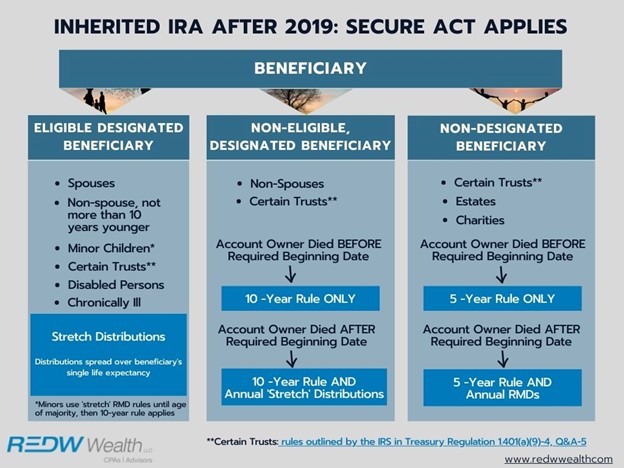

Congressional passage of the SECURE Act in 2019 significantly changed the landscape for retirement accounts, particularly with its sweeping changes to Required Minimum Distributions (RMDs). Its statutory language— particularly with the timing of withdrawals from IRAs inherited after December 31, 2019—created disagreement among tax and financial professionals regarding interpretation of the new rules.

PREVIOUS INHERITED IRA RMD RULES

Before the SECURE Act, individual non-spouse beneficiaries had three options.

- Take minimum annual distributions over their lifetime (a stretch distribution)

- Take a one-time lump sum distribution

- Use the five-year rule

Under the five-year rule, distribution amounts could vary each year, as long as beneficiaries distributed the entire IRA balance by December 31 of the year of the fifth anniversary of the IRA (Individual Retirement Account) owner’s death.

RMD’s were designed to allow the IRS (Internal Revenue Service) to collect tax on deferred assets and ensure the IRA investments do not grow tax-deferred forever. If a beneficiary withdrew less than their annual required minimum distribution, they could owe a 50% penalty tax on the difference. Inherited IRA mandatory distribution rules depend on when the account holder passed and their age when passing.

SECURE ACT 10-YEAR RMD INTERPRETATION

The SECURE Act updated the distribution period to 10 years and most assumed it was an extension of the five-year rule. With that assumption, you were compliant if you wanted to take a distribution in some years and not others. The distributions could all be made in one or two years as long as the inherited account was fully distributed by the end of the 10th year after death.

Article Continues Below

- Financial Wellness: Cognitive Decline & Your Financial Health

- Inflation & the R-Word: Noise from Sound – Are We in a Recession?

- Fiduciary Advisors: What is a Fee-Only Fiduciary Advisor?

IRS 2022 GUIDANCE ON RMD TIMING

In February 2022, the IRS published a Proposed Rule documenting their interpretation of how the SECURE Act amended Required Minimum Distributions. The proposed regulations took taxpayers and professionals by surprise when no flexibility was allowed on Inherited IRA required distribution timing.

Under the Proposed Rule, Non-Eligible Designated Beneficiaries (certain non-spouses and certain trusts) who inherit retirement accounts whose owners die on or after the Required Beginning Date (when owners begin taking minimum required distributions) would have to comply with both the ‘stretch’ distribution rules in place before the SECURE ACT and would also be required to distribute the entire account balance by the end of the 10th year after death.

DELAYED IMPLEMENTATION

In October 2022, the IRS issued IRS Notice 2022-53 to address the confusion around the timing of RMDs. Many non-eligible beneficiaries had not taken RMDs in 2020 and 2021 due to initial interpretations of the SECURE Act. The new guidance delays the implementation of the annual required minimum distributions of an inherited IRA over a 10-year period to not applying until the 2023 distribution calendar year.

If you have not been complying with the SECURE Act in the manner described in the IRS Proposed Rule, you have until the 2023 distribution calendar year to begin complying. You may apply for a refund if the excise tax has already been paid.

AMBIGUITY REMAINS

Still unanswered is the question of whether you need to take past RMDs from 2020, 2021 and now 2022. It is not explicit in the notice, but our interpretation is that you do not. As for 2020, the CARES Act implied those who have inherited an IRA are not required to take RMDs in 2020, however, the language of the CARES ACT does not specifically mention inherited IRAs.

Since there isn’t a penalty for not taking a distribution, you do not need to take the 2020-2022 RMDs. There is no mention of a requirement to take 2020, 2021 or 2022 distributions and no requirement to file Form 5329 to request a waiver of the excise tax.

We do want to emphasize that in the case of an inherited 401k, there is clarification on missed RMD’s. If a beneficiary inherits a qualified retirement plan, and the designated beneficiary wants to direct-roll it into an inherited IRA, missed RMDs are not eligible for rollover and need to be distributed. You will not owe an excise tax, but the RMDs still need to be withdrawn for purposes of determining what is an eligible rollover distribution.

PROFESSIONAL GUIDANCE IS AVAILABLE

Inherited IRAs can quickly become complex. While the IRS has clarified some SECURE ACT rules, most inherited retirement account cases call for more specific conversations and guidance. If you have specific questions concerning your situation, contact Christine Papelian and Rita James using the form below to begin assessing whether you are thoroughly complying with all regulations and employing optimal tax minimization strategies for your distributions.

Disclosure statement:

Information and instruction shared in the article above from REDW Wealth does not guarantee outcomes or performance or quality of services provided to REDW Wealth clients by REDW Wealth or its employees.