With the advent of the new year, we’ve experienced many changes. A new administration has taken office, the vaccine rollout has accelerated, another stimulus package has been approved, and economies in the U.S. and elsewhere have been opening up.

First quarter GDP growth in the U.S. has just been reported as 6.4% (annualized), and estimates for the full 2021 year are between 6% and 7%. We continue to see strong job creation numbers and the unemployment rate has dropped from the pandemic high of 14% to 6%. While we are still not at pre-COVID unemployment levels, most estimates say that by mid-2022, or sooner, the unemployment rate will drop back to pre-COVID levels. We applaud the technological innovations that allowed so much of our workforce to pivot to working from anywhere, as well as the rapid development of COVID vaccines. As the economy continues to take in these innovations (and others), we continue to expect them to lead to continued economic growth and new opportunities.

As is often the case, policy concerns do exist. The President has unveiled a number of tax change initiatives that in their totality could hamper investment and economic growth. However, we believe the President’s plan is a starting point for negotiations and that actual changes will be different. As the tax and infrastructure spending bills wind their way through Congress, we will continue to provide analysis and commentary.

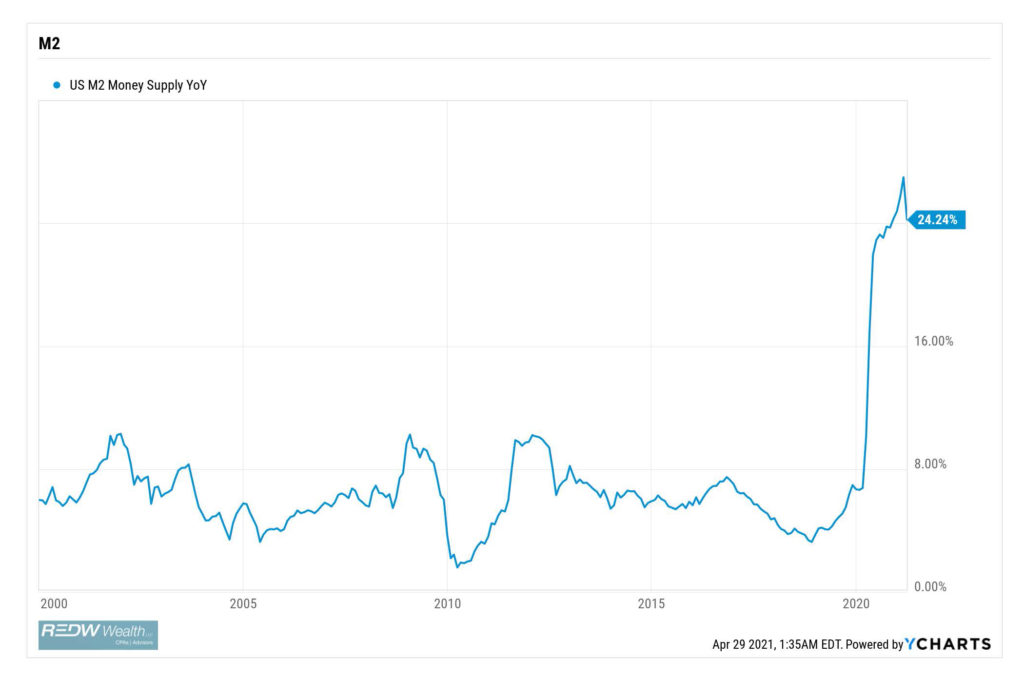

Another area of concern has been the sudden, rapid growth in the M2 money supply in 2020, as shown in the chart included here. Compare this to 2008, when the Federal Reserve had multiple rounds of quantitative easing.

During 2008 and 2009, the money supply did not grow very much, relative to 2020, because liquidity was stuck within the financial system as banks increased their reserves and tightened their lending standards. In 2020, more money found its way into the hands of consumers and investors as the government sent out stimulus checks and increased unemployment benefits and the Federal Reserve pumped liquidity into the markets through direct asset purchases. Milton Friedman defined inflation as too many dollars chasing too few goods. With the money supply having grown so much (too many dollars), there is concern it will chase too few goods (and services), leading to higher inflation. While some inflation is perfectly acceptable for a recovering and growing economy, we will continue to monitor the situation.

As we observe economic changes both here and abroad, we at REDW Wealth continue in our commitment to help our clients navigate the waters of their finances. As you communicate with your Relationship Manager, please let us know about any changes in your life or goals so that we can address them.

Copyright 2021 REDW Wealth, LLC. All Rights Reserved. This publication is intended for general informational purposes only and should not be construed as investment, financial, tax, or legal advice.