by Laura Hall, CIMA®, AIF®, Senior Portfolio Manager/Director of Client Services, REDW Wealth, LLC

From Capital Conversations (Winter 2019) – View Newsletter

Have you ever wondered what happens in the background or behind the scenes before one of the professionals at REDW Wealth meets with a client to present and discuss a tax return or financial plan, or quarterly portfolio reports?

Over the years, a number of our clients have asked that question and been surprised at the answer. After all, it is reasonable to want to know what we do that is not readily apparent, and yet is necessary and even critical in order for us to be able to help our clients prepare for, respond to and focus on what is important to them. Whether the subject matter is tax, financial planning or asset management, all that we do for our clients is done with their best interest in mind.

The Technical Side

There is a technical side to the services we provide to our clients that is reflected in the letters following our names. The letters CFP®, CPA, CFA, CIMA®, JD, AEP, EA, and AIF®, for example, demonstrate that specialized knowledge has been acquired after hours of course work and years of work experience, and once one or more exams has been successfully passed. However, obtaining those letter designations is just the beginning.

Depending upon the designation, a certain number of continuing education hours—from 6 to 40 hours, each—must be completed annually, not only to continue to use the initials behind our names, but also to maintain the technical knowledge necessary to provide a complete financial picture to our clients that contains accurate and timely information. Many clients and potential clients mistakenly believe that technical skills and knowledge are a given, but it requires a commitment of both time and expense on the part of each of us, as well as on our firm, to acquire the initials and keep current on the knowledge that supports the continued use of those initials.

The Soft Side

There is also a “soft†side to the services we provide, which is qualitative in nature, versus the technical side, which is quantitative.

On the softer side, your Relationship Manager, asks open-ended questions, wants to know how our clients “feel†about the goals and objectives they have established, celebrates successes and helps work through challenges that come up as a part of life. Your Relationship Manager acts as a resource for other matters that are not of a financial nature, but are important, listens when our clients talk about emotional and difficult conversations that are a part of revising goals and objectives, and is honestly interested in our clients’ lives on all levels—financial, professional and personal.

Behind the Scenes

Regardless of the service we provide to our clients, there are a number of activities that happen behind the scenes that enable us to prepare an accurate tax return, present a comprehensive financial plan, or discuss quarter-end portfolio reports.

Team members throughout REDW’s Tax department have attended a number of meetings to ensure they fully understand the Tax Cuts and Jobs Act (TCJA)—the most sweeping tax legislation since the Tax Reform Act of 1986 became law. Acquiring an understanding of all aspects of the new tax law has been critical for all team members involved in preparing tax returns, as the 400-page bill includes a number of changes impacting individuals and businesses alike, some of which are complex and have resulted in an ongoing interpretation of the new law.

While this Act deals with federal taxes, there are also State and Local Taxes that require in-depth knowledge of each state’s tax laws and, in some cases, additional taxes. Having access to this specialized expertise within the firm is invaluable if it becomes necessary for us to obtain a speedy resolution to complex tax issues on our clients’ behalf. Regardless of the office that prepares a specific return, a review process is in place with numerous steps to ensure that all tax returns are prepared correctly.

To develop a plan that is meaningful and impactful for our clients, our financial planners must obtain a comprehensive view of a client’s entire financial life. To serve individuals, they must have the skills and knowledge to analyze prior year tax returns, understand a client’s individual tolerance for risk in their investment portfolio, perform a comprehensive review of health, life, disability, home and auto insurance, and ensure the proper estate plan is in place. To serve business owners, they must also understand executive compensation, all types of employee benefits, and succession planning.

Our financial planners may be required to work with professionals outside the firm to obtain the best possible plan for a client, or with other REDW professionals to present the best possible analysis with the best possible outcome for the client. Finding the right software to produce a comprehensive, understandable, accurate and readable report may also necessitate research into various applications available in the marketplace, followed by testing to ensure the software is utilized as efficiently as possible. And regardless of whether a financial plan is prepared for an individual or a business owner, all analyses and recommendations must be viewed through a fiduciary lens, with strategic tax planning and risk management considerations included.

The culmination of all the behind-the-scenes work performed by our asset management team is the presentation and discussion of portfolio reports, which involve monitoring the performance of the market and indexes, or economic and technical indicators. This data is downloaded daily and reconciled to confirm the accuracy of the reports. We hold monthly Investment Committee meetings that allow members to exchange outlooks and opinions, and discuss the analysis of assets used in our clients’ portfolios, as well as new research shared in industry publications.

Annually, data is collected, analyzed, presented and discussed to determine if changes should be made to the target allocations for asset classes included in our clients’ portfolios. Our team members also research, test and implement new software to make certain the information presented in reports is as clear as possible. And to verify we operate within the regulations and rules of the Securities and Exchange Commission (SEC), team members perform compliance testing throughout the year.

Sometimes it is obvious and apparent what we do for our clients and sometimes it is not. In any case, the professionals of REDW Wealth strive to provide wisdom, accessibility, support, trust, time and meaningful conversations to move our clients’ lives forward. Just ask us. We are here to help.

505.998.3233

bsanchez@redw.com

Meet Bernadine Sanchez, Operations Manager/Investment Analyst

Since joining the team in 2015 originally as an Operations Specialist, Bernadine now oversees the daily operations of REDW Wealth’s Asset Management section as Operations Manager. As an Investment Analyst, she also analyzes and monitors client portfolios, recommends investment strategies and executes trades for portfolios. She holds a securities license and is currently pursuing the Accredited Investment Fiduciary (AIF®) designation, which signifies competency in fiduciary responsibility and the ability to apply fiduciary practices.

Did you know?

- The Firm: As we enter another tax season, the tax professionals in our Phoenix and Albuquerque offices, including those in REDW Wealth, have worked diligently to understand how the Tax Cuts and Jobs Act of 2017 will impact all of our clients. These tax team members have attended numerous continuing education sessions with the goal of preparing tax returns accurately to ensure that every credit, tax cut and deduction for which our clients are eligible are correctly claimed.

- The Economy: If you are curious about the number of electric vehicles on the roads around the world, the total in 2018 surpassed three million – a 50% increase over 2016, according to the International Energy Agency (IEA). Source: Wall Street Journal

- Our Clients: Thank you to all of our clients who answered the three-question survey we e-mailed in February. Your responses will help REDW Wealth provide the services you need and have asked for, along with the desired experiences that come with those services.

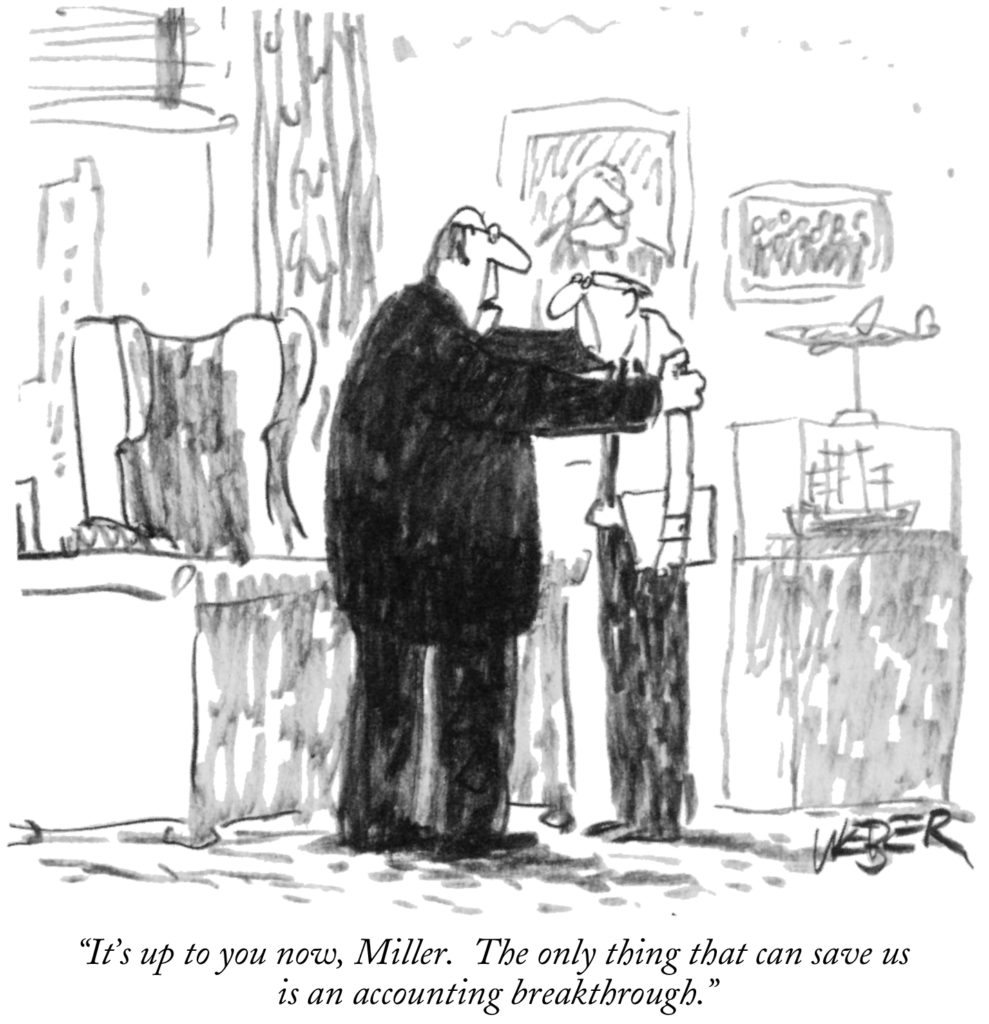

©Robert Weber / New Yorker

Copyright 2019 REDW Wealth LLC. All Rights Reserved. This publication is intended for general informational purposes

Copyright 2019 REDW Wealth LLC. All Rights Reserved. This publication is intended for general informational purposes only and should not be construed as investment, financial, tax, or legal advice.Â