From Capital Conversations (June 2016) – View Newsletter

While the traditional deadline for filing federal and state income taxes is April 15th, this year everyone received a three-day extension to April 18th due to the celebration in Washington D.C. of a little known holiday: Emancipation Day. Emancipation Day is the day President Abraham Lincoln signed the Compensated Emancipation Act, which freed approximately 3,100 slaves living in the District of Columbia.

This holiday is normally observed on April 16th, but since April 16th fell on a Saturday this year, it was instead celebrated on Friday, April 15th. “When April 15th falls on a Saturday, Sunday or legal holiday, a return is considered timely filed if it is filed on the next succeeding day that is not a Saturday, Sunday or legal holiday,†explained Internal Revenue Service (IRS) spokesman Ubon Mendie. “The term ‘legal holiday’ includes a legal holiday observed in the District of Columbia,†and according to the IRS, D.C. legal holidays are treated as federal holidays for tax-filing purposes. Former D.C. mayor Anthony A. Williams declared Emancipation Day an official District holiday 15 years ago. The city government shuts down for the day, although the federal government and most private businesses in the city remain open, resulting in a low profile holiday.

Tax Frauds and Scams

Tax season often ushers in the appearance of those who want to separate you from your personal financial information for their gain—and your loss. Others need no help in implementing strategies to either reduce their tax bite or obtain tax breaks they do not deserve. The IRS Criminal Investigation Division works with the Department of Justice to ferret out those fraudsters and prosecute them. Each year the IRS publishes a list of common frauds that taxpayers may encounter anytime, but which may be especially visible during tax season.

Here are five of the most common frauds in 2016:

Identity theft—This is an ongoing concern for the IRS when fraudsters use a taxpayer’s stolen Social Security number to file a false return and claim a fraudulent refund. Several of our clients have experienced this type of identity theft, which was revealed when the genuine tax return was filed after the fraudulent tax return was filed. REDW Stanley encourages our clients to be cautious when viewing emails, receiving telephone calls or getting advice on tax matters because scams can take sophisticated forms. Protect the data on your computer via backups and encryption and only disclose your Social Security number when necessary.

Phone scams—Criminals posing as IRS agents call unsuspecting taxpayers and ask for personal financial information that can then be used to fraudulently establish credit cards, withdraw cash from bank accounts, and make purchases in the unsuspecting taxpayer’s name. Another phone tactic is to announce that a large refund is due, and personal financial information is needed to verify the taxpayer’s identity, along with a bank account number in which to deposit the refund. The IRS wants taxpayers to know it will never:

- call to demand payment without first mailing a payment due notice;

- demand payment without giving the taxpayer the opportunity to question or appeal the amount due;

- require a taxpayer to use a specific method of payment; or

- ask for credit card or debit card numbers over the phone.

If you do receive a call from someone posing as an IRS agent, hang up immediately without giving out any information.

Phishing—Fraudsters use email to get taxpayers to disclose personal financial information, so be cautious about opening odd or unusual emails, even if those emails appear to be from clients, friends or family. Criminals can use email to pretend to be a person or organization the taxpayer knows or trusts to request personal financial information. Email accounts are hacked and mass emails sent under the hacked person’s name with links that, once clicked on, can provide access to the data on a specific computer. Criminals also establish phony web sites that appear genuine but are designed to acquire passwords, Social Security numbers or bank and credit card numbers. As with phone scams, the IRS will not send an email about taxes or a refund due without first mailing a payment or refund due notice or giving the taxpayer the opportunity to question or appeal taxes due. As a precaution, do not click on an unexpected email claiming to be from the IRS.

Fake  Charities—Charitable taxpayers should be suspicious of not-for-profits soliciting donations that have names similar to nationally known and legitimate organizations. If requested, legitimate charities will provide their tax numbers or their Employer Identification Numbers. You can verify the tax-deductible status of a contribution to a specific organization by accessing the Exempt Organizations Select Check on the IRS web site www.irs.gov/charities-non-profits/exempt-organizations-select-check. A similar type of scam occurs after a significant natural disaster strikes, when awareness of the need to help the victims is high. The IRS suggests contributing only to recognized charities, as well as making donations using a check or credit card, with the cancelled check or credit card receipt serving as documentation of the gift for tax purposes.

Claiming False Deductions or Falsifying Income—For those taxpayers who file their own returns, sometimes the temptation is just too great to report information on their returns that inflates deductions or expenses, with the result of underpaying taxes owed or receiving a larger refund. In other instances, taxpayers inflate income or include fictitious income on their return in order to maximize refundable credits like the Earned Income Tax Credit. Falsifying income could result in the taxpayer facing a large penalty to repay the erroneous refund, with criminal prosecution and jail time possible in egregious cases.

The statute of limitations for IRS audits of income tax returns is three years from the date a tax return is filed. This means the IRS must review and contest the return within three years of the filing date in order to have a cause of action against the taxpayer. The statute of limitations is extended to six years if the IRS suspects there is a substantial omission of gross income on a tax return, “substantial†being defined as more than 25% of the gross income reported on the tax return. However, in cases where a taxpayer is suspected of committing fraud when filing the return, there is no limit to the statute of limitations. Fraud implies that the taxpayer intentionally disregarded tax rules or misstated information included on the return.

Using tax preparation software is one way to help ensure that a tax return is prepared correctly and that benefits are claimed to which the taxpayer is actually entitled. Using a tax professional is another way to help ensure tax returns are prepared accurately and filed properly.

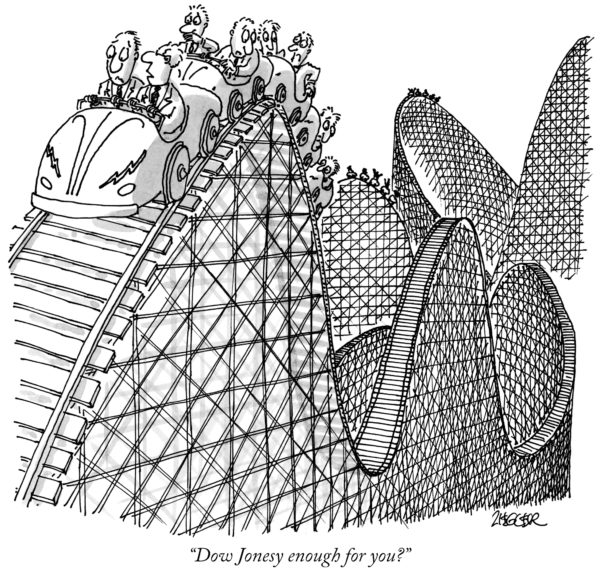

© Jack Ziegler

Copyright 2017 REDW Stanley Financial Advisors, LLC. All Rights Reserved. This publication is intended for general informational purposes only and should not be construed as investment, financial, tax, or legal advice.